RSI-BEST INTRADAY INDICATOR EXPLAINED TO MAKE PROFIT IN STOCK & COMMODITY IN TAMIL & ENGLISH

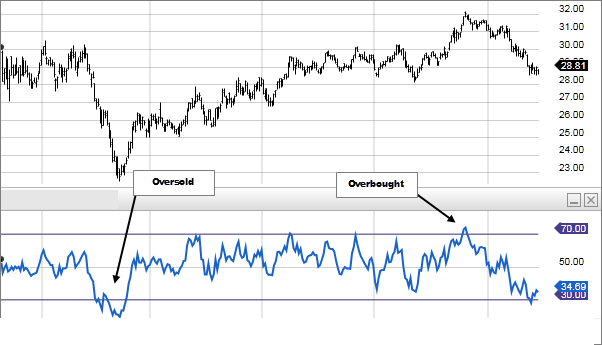

The RSI (relative strength index) is the momentum indicator that read the magnitude of recent traded price changes to index the upper circuit overbought & lower circuit over sold. The default value of RSI is 14 period in parameter & 70 as overbought area and 30 as oversold areas. The traders use the Rsi indicator for different purpose for intraday trading with different parameter settings. Like the most common parameters used in RSI is 80 as overbought and 20 as oversold. The traders make a sell once the price reached the overbought area 80 & make a buy once the price touch the oversold area 20. But here we are going to see a Real Secret of Using Rsi Indicator in Tamil (video) and in English.

RSI Trading Strategy For Intraday In Tamil

For Intraday Rsi Trading Strategy in Tamil Kindly Visit our YouTube Channel Chidhucommodity

This blog of content are about to explain what is mean by Rsi Indicator & How to use RSI indicator to make or earn a real profit in stock market. As said in above the Rsi default value are 14 Period and 70 as overbought & 30 as oversold. The people making a wrong decision by making a sell at overbought and making a Buy at oversold. The real method of using RSI intraday indicators is we should not make a Buy at Oversold (30) and we should not make a Sell at Overbought (70) Region. Actually we should look forward to buy at Overbought (70) & should look forward to make a Sell at Oversold (30) area. Kindly follow our titles below to Know More about Rsi indicator.

RSI Overbought & Oversold Meaning in Tamil

The very simple Logic, if price reached the 70 range it is a meaning of Overbought & if price reached the 30 range it s a meaning of oversold. For Tamil version of overbought & oversold meaning visit the secrets of Rsi.

The above image well explains us the real movement of Rsi Indicator. Many traders use the Rsi Overbought and Oversold in Wrong way. If Rsi reached the overbought (70) area it mean the market is in positive mode & if Rsi reached the oversold (30) area it mean the market is in negative mode. But the traders understand the Rsi in inverse method. They buy at (30) and Sell at (70).

Rsi Divergence & Convergence Indicator in Tamil

Rsi Divergence and Convergence method are most followed method by most of the traders. Soon we will update about a RSI Divergence & Convergence indicator trading method in Tamil in our YouTube channel.

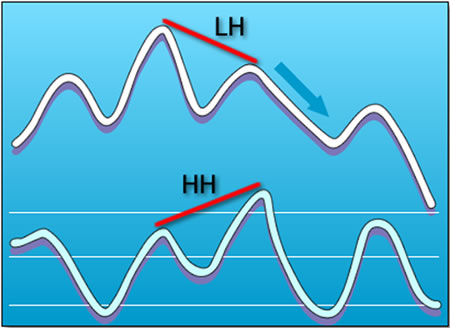

Rsi Divergence:

Rsi divergence are very simple to understand. Look at the image above the Rsi Value are Decrease in value and and market price are increase in value. It mean market are trying to create a strong down fall movement. Once the breakout happen in Price the fall will happen.

Rsi Convergence:

The RSI convergence is simple forward of Rsi divergence. Here in RSI convergence the price make a higher Low and the Rsi Make a Higher high. what it comes to mean is the change of trend could happen in that following script.

RSI Intraday Indicator Explained In Tamil

As said in above title for RSI Intraday Indicator in Tamil Visit our Channel (or) can view the video of content in Tamil by clicking the RSI Intraday Indicator Explained in Tamil Link.

I personally use RSI trading indicator for last 5 years in stock market, commodity market and in Forex market. In the following view of content I will explain of how to use Rsi indicator in Tamil, how to earn using Rsi in Tamil, how to get profit using Rsi in Tamil, how to make profit using Rsi in Tamil, how to earn money using Rsi in Tamil, how to use Rsi in stock market in Tamil, how to use Rsi in day trading in Tamil, how to use Rsi for swing trading in Tamil, how to use Rsi divergence in Tamil, how to use Rsi index in Tamil, how to use Rsi in trading in Tamil and will explain many more about the Secret of RSI (relative strength index).

Secret of Using RSI Intraday Trading Indicator in Tamil

Since we are from Tamil Nadu we post most of the video by Tamil Language. Soon we will post a RSI Secret Method in Tamil and English.

Follow This Secret:

Rsi main secret is the 50 cross level. If Rsi crossed from overbought to Below 50 It mean the market might go downside (or) it means a fall could happen from above. If Rsi crossed from oversold to above 50 range it mean us the market might move upside from the price of fall. So always concentrate to use the Rsi only above the 50 cross range. Hope this explanation explains you about the Rsi divergence & convergence and many more about to make a profit using Rsi in swing trading.